Detailed AutoTrader Walkthrough#

A popular MACD crossover strategy will be developed in this section. An important note here is that this strategy assumes that the trading instrument can be short-sold.

Warning

This walkthrough is intentionally very thorough and detailed. If you don’t mind g lossing over the finer details, or are comfortable programming in Python, the condensed walkthrough might be better suited to you.

Strategy Rules#

The rules for the MACD strategy are defined as follows.

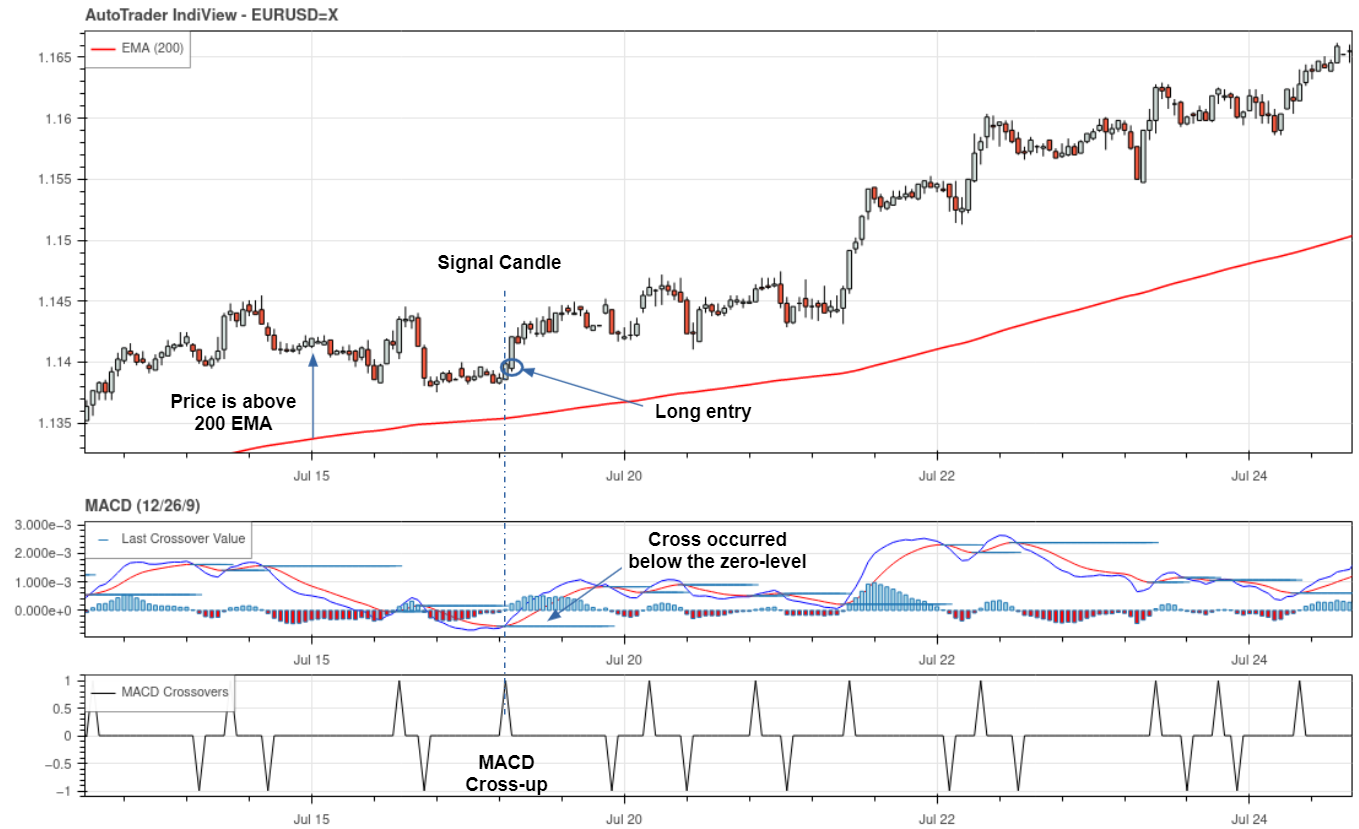

Trade in the direction of the trend, as determined by the 200-period exponential moving average (EMA) (if the current price above 200EMA, there is an up-trend and only long trades should be made, and if price is below, there is a down-trend and only short trades should be made).

Enter a long position when the MACD line crosses up over the signal line, and enter short when the MACD line crosses down below the signal line.

To ensure only the strongest signals, the MACD crossover must occur below the histogram zero line for long positions, and above the histogram zero line for short positions.

Stop losses are set at recent price swings/significant price levels. We will use AutoTrader’s swing detection indicator for this.

Take profit levels are set at 1:1.5 risk-to-reward, meaning that winning trades make 1.5 times more than losing trades lose.

Strategy Parameters#

From these rules, the following strategy parameters can be defined:

Parameter |

Nominal value |

|---|---|

ema_period |

200 |

MACD_fast |

12 |

MACD_slow |

26 |

MACD_smoothing |

9 |

RR |

1.5 |

An example of a long entry signal from this strategy is shown in the image below (generated using AutoTrader IndiView).