Condensed AutoTrader Walkthrough#

This page is a condensed version of the detailed walkthrough, which goes through the process of building and running a strategy in AutoTrader. If you are familiar with Python, it should be sufficient to get you up and running.

Tip

The code for the MACD crossover strategy shown in this tutorial can be found in the demo repository.

Strategy Rules#

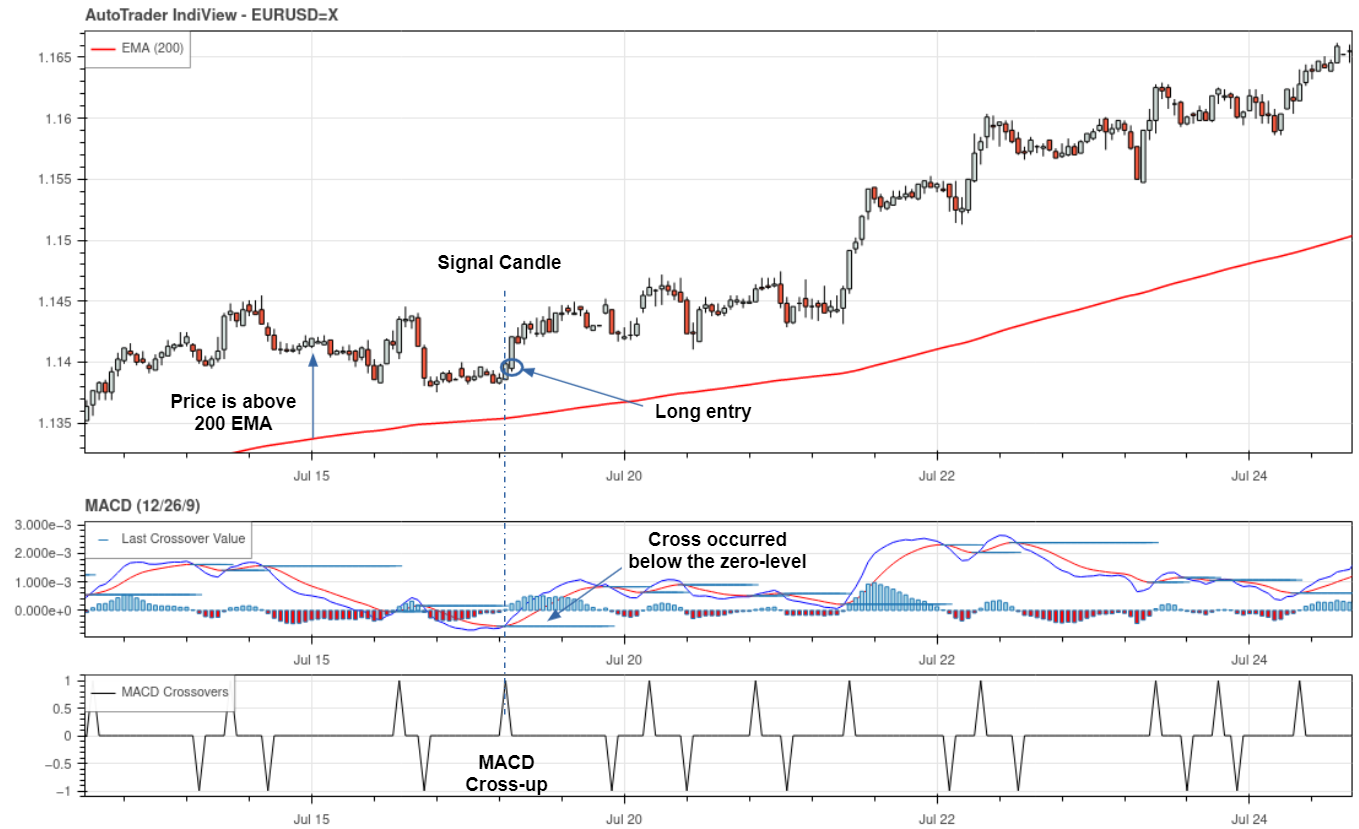

The rules for the MACD crossover strategy are as follows.

Trade in the direction of the trend, as determined by the 200EMA.

Enter a long position when the MACD line crosses up over the signal line, and enter a short when the MACD line crosses down below the signal line.

To ensure only the strongest MACD signals, the crossover must occur below the histogram zero line for long positions, and above the histogram zero line for short positions.

Stop losses are set at recent price swings/significant price levels.

Take profit levels are set at 1:1.5 risk-to-reward.

An example of a long entry signal from this strategy is shown in the image below (generated using AutoTrader IndiView).

Strategy Construction#

Strategies in AutoTrader are built as class objects. They contain the logic required to transform data into a trading signals. Generally speaking, a strategy class will be instantiated with the name of the instrument being traded and the strategy parameters, but you can customise what gets passed in using the strategy configuration.

Configuration#

Follow Along

Follow along in the demo repository: config/macd.yaml

The strategy configuration file defines all strategy

parameters and instruments to trade with the strategy. The PARAMETERS

of this file will be passed into your strategy for you to use there.

# macd.yaml

NAME: 'Simple Macd Strategy' # strategy name

MODULE: 'macd' # strategy module

CLASS: 'SimpleMACD' # strategy class

INTERVAL: '1h' # stategy timeframe

PERIOD: 300 # candles required by strategy

SIZING: 'risk' # sizing method

RISK_PC: 1.5 # risk per trade (%)

PARAMETERS: # strategy parameters

ema_period: 200

MACD_fast: 12

MACD_slow: 26

MACD_smoothing: 9

# Exit level parameters

RR: 1.5

WATCHLIST: ['EURUSD=X'] # strategy watchlist

Class Object#

Although strategy construction is extremely flexible, the class must

contain an __init__ method, and a method named generate_signal. The

first of these methods is called whenever the strategy is instantiated.

By default, strategies in AutoTrader are instantiated with three named arguments:

The name of the instrument being traded in this specific instance (

instrument).The strategy parameters (

parameters)The trading instruments data (

data)

When backtesting, the data provided to __init__ is for the entire

backtest period. This allows you to calculate all indicators for

plotting purposes down the line, but it shouldn’t be used in the

generate_signal method, as this could introduce look-ahead.

Aside from the __init__ method, your strategy must have a method named

generate_signal. This method gets called by AutoTrader everytime new

data becomes available, and expects a trading Order in

return.

A long order can be created by specifying direction=1 when creating the

Order, whereas a short order can be created by specifying direction=-1.

If there is no trading signal this update, you can create an

empty order with just Order(). We also define our exit targets

by the stop_loss and take_profit arguments. The strategy below uses

the generate_exit_levels helper method to calculate these prices.

Tip

Take a look at the template strategy provided in the Github repository.

# macd.py

from finta import TA

from autotrader import Order, indicators

class SimpleMACD:

"""Simple MACD Strategy

Rules

------

1. Trade in direction of trend, as per 200EMA.

2. Entry signal on MACD cross below/above zero line.

3. Set stop loss at recent price swing.

4. Target 1.5 take profit.

"""

def __init__(self, parameters, data, instrument):

"""Define all indicators used in the strategy.

"""

self.name = "Simple MACD Trend Strategy"

self.params = parameters

self.instrument = instrument

# Initial feature generation (for plotting only)

self.generate_features(data)

# Construct indicators dict for plotting

self.indicators = {'MACD (12/26/9)': {'type': 'MACD',

'macd': self.MACD.MACD,

'signal': self.MACD.SIGNAL},

'EMA (200)': {'type': 'MA',

'data': self.ema}

}

def generate_features(self, data):

"""Updates MACD indicators and saves them to the class attributes."""

# Save data for other functions

self.data = data

# 200EMA

self.ema = TA.EMA(self.data, self.params['ema_period'])

# MACD

self.MACD = TA.MACD(self.data, self.params['MACD_fast'],

self.params['MACD_slow'], self.params['MACD_smoothing'])

self.MACD_CO = indicators.crossover(self.MACD.MACD, self.MACD.SIGNAL)

self.MACD_CO_vals = indicators.cross_values(self.MACD.MACD,

self.MACD.SIGNAL,

self.MACD_CO)

# Price swings

self.swings = indicators.find_swings(self.data)

def generate_signal(self, data):

"""Define strategy to determine entry signals."""

# Feature calculation

self.generate_features(data)

# Look for entry signals (index -1 for the latest data)

if self.data.Close.values[-1] > self.ema[-1] and \

self.MACD_CO[-1] == 1 and \

self.MACD_CO_vals[-1] < 0:

# Long entry signal detected! Calculate SL and TP prices

stop, take = self.generate_exit_levels(signal=1)

new_order = Order(direction=1, stop_loss=stop, take_profit=take)

elif self.data.Close.values[-1] < self.ema[-1] and \

self.MACD_CO[-1] == -1 and \

self.MACD_CO_vals[-1] > 0:

# Short entry signal detected! Calculate SL and TP prices

stop, take = self.generate_exit_levels(signal=-1)

new_order = Order(direction=-1, stop_loss=stop, take_profit=take)

else:

# No trading signal, return a blank Order

new_order = Order()

return new_order

def generate_exit_levels(self, signal):

"""Function to determine stop loss and take profit prices."""

RR = self.params['RR']

if signal == 1:

# Long signal

stop = self.swings.Lows[-1]

take = self.data.Close[-1] + RR*(self.data.Close[-1] - stop)

else:

# Short signal

stop = self.swings.Highs[-1]

take = self.data.Close[-1] - RR*(stop - self.data.Close[-1])

return stop, take

Backtesting#

An easy and organised way to deploy a trading bot is to set up a run file. Here you import AutoTrader, configure the run settings and deploy your bot. This is all achieved in the example below.

# runfile.py

from autotrader import AutoTrader

at = AutoTrader()

at.configure(show_plot=True, verbosity=1, feed='yahoo',

mode='continuous', update_interval='1h')

at.add_strategy('macd')

at.backtest(start = '1/1/2021', end = '1/1/2022')

at.virtual_account_config(leverage=30)

at.run()

Let’s dive into this a bit more:

We begin by importing AutoTrader and creating an instance using

at = AutoTrader().Next, we use the

configuremethod to set the verbosity of the code and tell AutoTrader that you would like to see the backtest plot. We also define the run mode and update interval to1h, meaning that we will step through the backtest data by 1 hour at a time.Next, we add our strategy using the

add_strategymethod. Here we pass the file prefix of the strategy configuration file, located (by default) in theconfig/directory. Since our strategy configuration file is namedmacd.yaml, we pass in ‘macd’.We then use the

backtestmethod to define the backtest period. In this example, we set the start and end dates of the backtest.Since we will be simulating trading (by backtesting), we also need to configure the virtual trading account. We do this with the

virtual_account_configmethod. Here we set the account leverage to 30. You can also configure trading costs, bid/ask spread, initial balance and other settings here.Finally, we run AutoTrader with the command

at.run().

Simply run this file, and AutoTrader will do its thing.

Backtest Results#

With a verbosity of 1, you will see an output similar to that shown below. As you can see, there is a detailed breakdown of trades taken during the backtest period. Since we told AutoTrader to plot the results, you will also see the interactive chart shown below.

___ __ ______ __

/ | __ __/ /_____/_ __/________ _____/ /__ _____

/ /| |/ / / / __/ __ \/ / / ___/ __ `/ __ / _ \/ ___/

/ ___ / /_/ / /_/ /_/ / / / / / /_/ / /_/ / __/ /

/_/ |_\__,_/\__/\____/_/ /_/ \__,_/\__,_/\___/_/

[*********************100%***********************] 1 of 1 completed

BACKTEST MODE

AutoTraderBot assigned to trade EURUSD=X with virtual broker using Simple Macd Strategy.

Trading...

31539600.0it [00:19, 1630112.41it/s]

Backtest complete (runtime 19.348 s).

----------------------------------------------

Trading Results

----------------------------------------------

Start date: Jan 20 2021 04:00:00

End date: Dec 31 2021 13:00:00

Duration: 345 days 09:00:00

Starting balance: $1000.0

Ending balance: $1140.75

Ending NAV: $1170.16

Total return: $140.75 (14.1%)

Maximum drawdown: -18.97%

Total no. trades: 175

Total fees paid: $0.0

Win rate: 21.7%

Max win: $36.51

Average win: $25.26

Max loss: -$21.57

Average loss: -$16.38

Longest winning streak: 4 trades

Longest losing streak: 11 trades

Average trade duration: 1 day, 3:43:38

Positions still open: 1

Cancelled orders: 5

Summary of long trades

----------------------------------------------

Number of long trades: 36

Win rate: 41.7%

Max win: $36.51

Average win: $25.22

Max loss: -$21.18

Average loss: -$17.23

Summary of short trades

----------------------------------------------

Number of short trades: 54

Win rate: 42.6%

Max win: $31.85

Average win: $25.28

Max loss: -$21.57

Average loss: -$15.86

Going Live#

Taking a strategy live is as easy as changing a few lines in your runfile.

Say you would like to trade your strategy on the cryptocurrency exchange

dYdX. Then, all you need to do is specify this

as the broker in the configure method, as shown below. You will

just need to make sure you have provided the relevant API keys in your

keys.yaml file to connect to your exchange.

from autotrader import AutoTrader

at = AutoTrader()

at.configure(verbosity=1, broker='dydx',

mode='continuous', update_interval='1h')

at.add_strategy('macd')

at.run()

What if you wanted to paper trade your strategy before putting real money into

it? Simply configure a virtual trading account and specify the exchange as

dydx (or whatever broker you specify in configure) and then you will

be paper trading! Doing this, AutoTrader’s virtual broker mirrors the real-time

orderbook of the exchange specified, making execution of orders as accurate as

possible.

from autotrader import AutoTrader

at = AutoTrader()

at.configure(verbosity=1, broker='dydx',

mode='continuous', update_interval='1h')

at.add_strategy('macd')

at.virtual_account_config(leverage=30, exchange='dydx')

at.run()